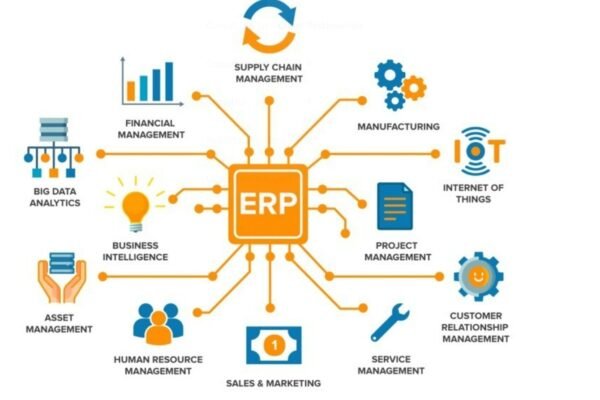

Revolutionize Business Systems: Core Elements of ERP Automation

Enterprise resource planning systems are the foundation of an organization’s operations, handling everything from finances to inventory. These technologies’ automation turns laborious, manual procedures into efficient workflows that require little human involvement. Businesses may decrease errors, and speed up operations, along with freeing up staff members to concentrate on value-added jobs that call for creativity…